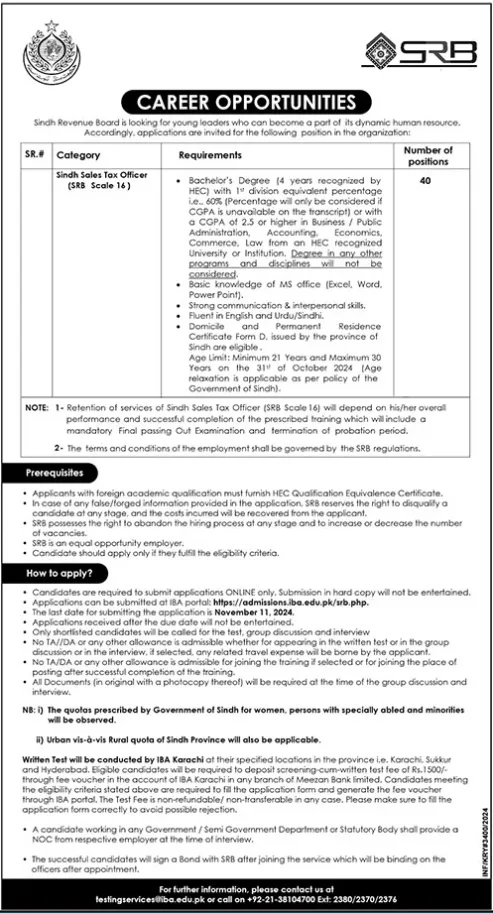

Sindh Revenue Board Latest Jobs 2024

The Sindh Revenue Board Latest Jobs 2024. The Sindh Revenue Board (SRB) offers a unique opportunity for young, talented, and ambitious individuals to join its team as Sindh Sales Tax Officers. This role provides a promising career path in public service, offering hands-on experience in taxation and financial administration. With 40 available positions, SRB aims to empower young professionals by integrating them into its dynamic workforce, enhancing the efficiency of Sindh’s taxation system. Sindh Revenue Board Latest Jobs 2024.

Overview of SRB

The SRB, established by the Government of Sindh, manages and collects Sindh Sales Tax. The board plays a critical role in generating revenue for the province, which supports various public services, infrastructure projects, and social welfare programs. Working at SRB not only allows contributions to the province’s economic development but also provides a platform for personal and professional growth within the public sector.

Career Opportunity at Sindh Revenue Board (SRB): Become a Sindh Sales Tax Officer

Position Vacant

Sindh Sales Tax Officer (SRB Scale 16)

- Total Positions Available: 40

- Location: Sindh Province

Eligibility Requirements

Candidates must meet the following requirements to apply for the Sindh Sales Tax Officer position:

Educational Qualification:

- A four-year Bachelor’s degree from a Higher Education Commission (HEC)-recognized university.

- Fields of study include Business/Public Administration, Accounting, Economics, Commerce, or Law.

- Academic Performance: Minimum 1st Division (60% or higher) if CGPA not mentioned on the transcript or a CGPA of 2.5 or above. Degrees in fields other than those specified not considered.

Skills and Abilities:

- Basic proficiency in MS Office (Excel, Word, PowerPoint).

- Strong communication and interpersonal skills.

- Fluency in English, Urdu, and Sindhi.

Residency Requirement:

- Candidates must possess a domicile and Permanent Residence Certificate (Form D) from the Sindh province.

Age Limit:

- Minimum: 21 years

- Maximum: 30 years (as of October 31, 2024). Age relaxation is available as per the Government of Sindh’s policy.

Additional Requirements for Foreign Graduates:

- Candidates with foreign qualifications must provide an HEC Equivalence Certificate to validate their degree.

Job Responsibilities

The selected Sindh Sales Tax Officers will manage sales tax administration and compliance within Sindh.

Responsibilities include assessing tax filings, enforcing tax laws, supporting revenue collection, and ensuring taxpayer compliance.

Successful completion of training, including a final examination, is mandatory for retention in the role.

Employment Terms

Appointment is subject to SRB’s terms and conditions, contingent on successful completion of probation and training, which includes a final examination.

Officially Advertisement

READ ALSO: Technology Upgradation Skill Development Jobs